A default is a failure to pay your loans on time, which can harm your credit score and credit rating. A default can make qualifying for loans and borrowing money harder because it causes your credit rating to decrease. Each credit rating agency tracks credit scores differently. Although defaults remain on your credit history for several years, we have some beneficial financial tips that may help improve your score.

What is Default?

A default occurs when the borrower fails to make repayments on credit. Consequently, the credit provider issues a default notice asking you to catch up with your payments; otherwise, they will close your account. Regardless of how much money you owe, if you still fail to make repayments, the default will be added to your credit file and stay there for six years from the date it is settled. Defaults can occur if you fail to repay outstanding debts to a financial institution, mobile phone company, or utility supplier. Overall, it is important to be financially literate to avoid a default from hurting your credit score.

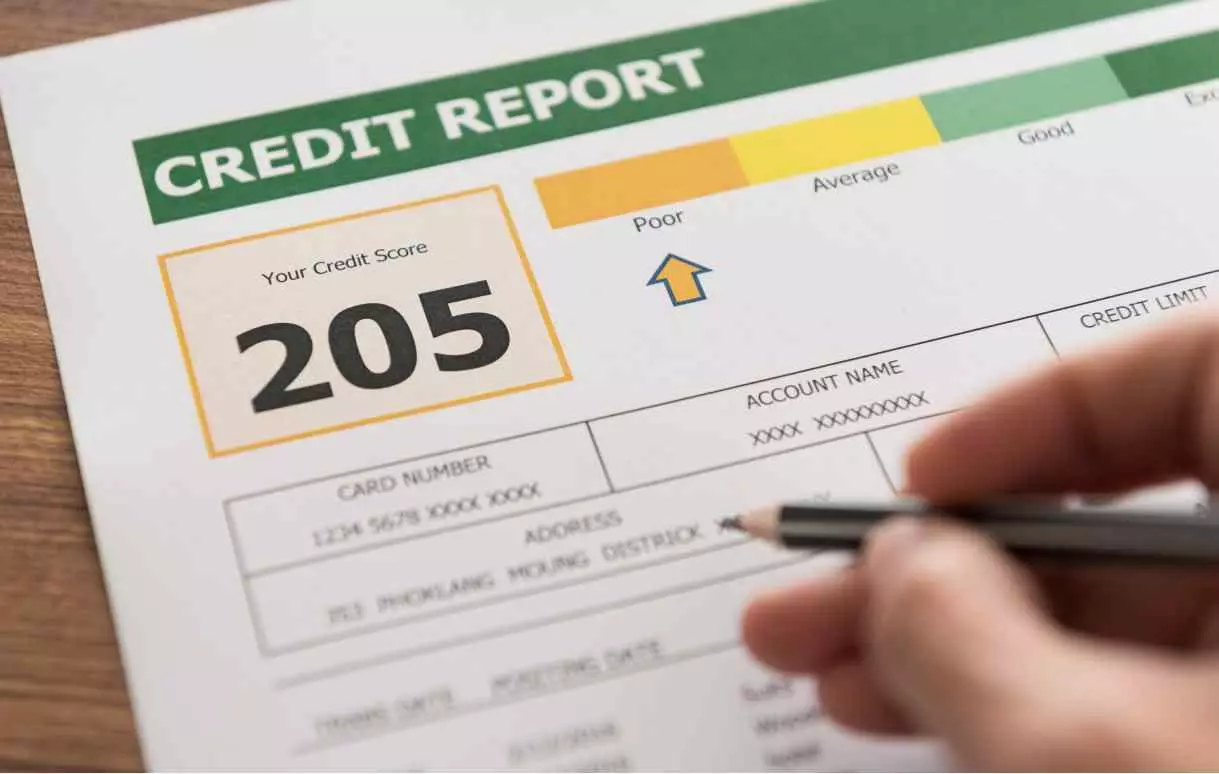

How Does the Default Affect Credit Score?

A default can significantly hurt your credit rating, making it harder to borrow money. Depending on the credit bureau, it could cause your credit score to drop by as much as 350 points. Also, the lender may opt to obtain a County Court Judgement (CCJ). In this case, the lender may seek legal recourse, which can further drop the borrower’s credit score by 250 points. Additionally, a missed payment on a bill or debt can lower your score by 80 points. Note that it doesn’t matter the amount you owe. For example, a £20 unpaid bill has the same effect as failing to make repayments on a £20,000 loan. However, the defaults are seen as less severe as they get older. For example, if a default is more than two years old, the negative effect falls to 250 points. If it is over four years old, it drops to 200 points.

The hits to your credit score because of defaulting on your loan aren’t reduced when you start or fully pay back the debt.

How to Resolve a Default?

There are numerous ways to boost your credit score. The most important thing to remember is to stop any new problems from being added to your credit record. Instead, consider the following to possibly improve your credit score fast:

- Stop applying for credit for six months. This may increase your score by 50 points.

- Keep a credit card for more than five years. This may improve your score by 20 points.

- Register to vote at your current address. This may improve your score by 50 points.

- Pay your car insurance in monthly instalments. This may increase your score by 20 points.

- Limit your credit card utilisation rate to 30%. This may improve your score by 90 points.

FAQ

Here are some mostly asked questions related to default. You will find the explanations of your questions.

What Do Lenders Think About Credit Utilisation?

Most lenders look unkindly at maxed-out credit cards because it may suggest that you are struggling financially. That creates doubt in the lender’s mind about whether you will be able to make successful repayments or default on your loan.

What Do Lenders Think About Defaults?

Typically, lenders are hesitant to work with an individual who has a default or an extremely low score. In these cases, borrowers with paid or unpaid defaults may be more likely to receive higher interest rate loans. As a result, individuals should always thoroughly consider their finances and repayment ability before obtaining a loan.

How Long Does Default Stay on the Credit File?

A default stays on your credit file for six years, which cannot be shortened.

Can a Default Be Removed?

A default could be removed from your credit file if recorded in error. If not, a default cannot be removed for six years after it has been recorded.

Does Your Credit Score Go up When a Default Is Removed?

After six years, your credit score may go up when a default is removed. This also depends on how many defaults you carry on your credit file. If you have more than one default on your file, your credit rating may not increase by much if one is removed.

What Is a Default Notice?

A default notice is a notification from your lender asking you to catch up with your payments. If you fail to make a payment after the default notice, they may put your account into default and close it. In other words, it is your last chance to stop a default from happening and pay the owed amount immediately. Note that not all lenders send a default notice even though it is good practice.

Can You Get Credit, Like a Loan or Mortgage, if You Have a Default?

A default negatively impacts a person’s ability to borrow money. When you apply for emergency loans, lenders check your credit score and history to assess your creditworthiness. A default on your file indicates that you have struggled to repay your debts in the past, and the lender may be hesitant to offer credit to you. However, it may be possible to get credit with a default on your record, but chances are the loan will carry high-interest rates and low limits.

How Many Points Does a CCJ Affect Your Credit Score?

A County Court Judgement can drop your credit score by 250 points in addition to the default you may already have.

Sum up

A default occurs when you fail to make repayments on credit. This can cause your credit score to drop by 350 points. Nonetheless, you can build your credit back and improve your chances of qualifying for credit by keeping a credit card for more than five years, registering to vote, and limiting your credit card utilisation rate below 30%.