Credit scores affect many of life’s necessities: rental or mortgage approval, credit cards, utilities, loan rates, and vehicle financing. If your credit score is lower than average, or if you’re building credit for the first time in your life, you may be seeking ways to improve your score.

But what qualifies as good credit, anyways? And what can you do to start improving your credit score immediately? Keep reading for answers to these pertinent questions and tips for credit score improvement.

What is a Good Credit Score?

The three major credit bureaus include Equifax, Experian, and TransUnion. Each agency weighs your credit differently, resulting in varying scores. Due to the differing scales, your credit score may fluctuate based on the agency you run a report through.

Credit scores are generally divided into different categories: excellent, good, poor, and bad. The three nationwide bureaus categorise “good credit” as the following:

- Equifax: 420-465

- Experian: 881-960

- TransUnion: 604-627

While these are certainly helpful benchmarks for a good credit score, there is no definitive range that will guarantee loan approval or disapproval.

There are a few options someone has if they are hoping to check their credit score without running a hard inquiry.

- Free Annual Credit Check. You are entitled to one free credit check from each of the three major credit bureaus every year.

- Credit Tracking Services. Financial organisations, such as CreditKarma, provide credit tracking services for customers. In some cases, these credit-tracking services are free. Credit monitoring can give a closer understanding of your credit status without damaging the score through a hard inquiry.

- Soft Credit Inquiries. The previously mentioned credit tracking services will typically conduct a soft credit check. This doesn’t affect your credit like a hard inquiry, which can temporarily lower your credit score.

How to Calculate Credit Score

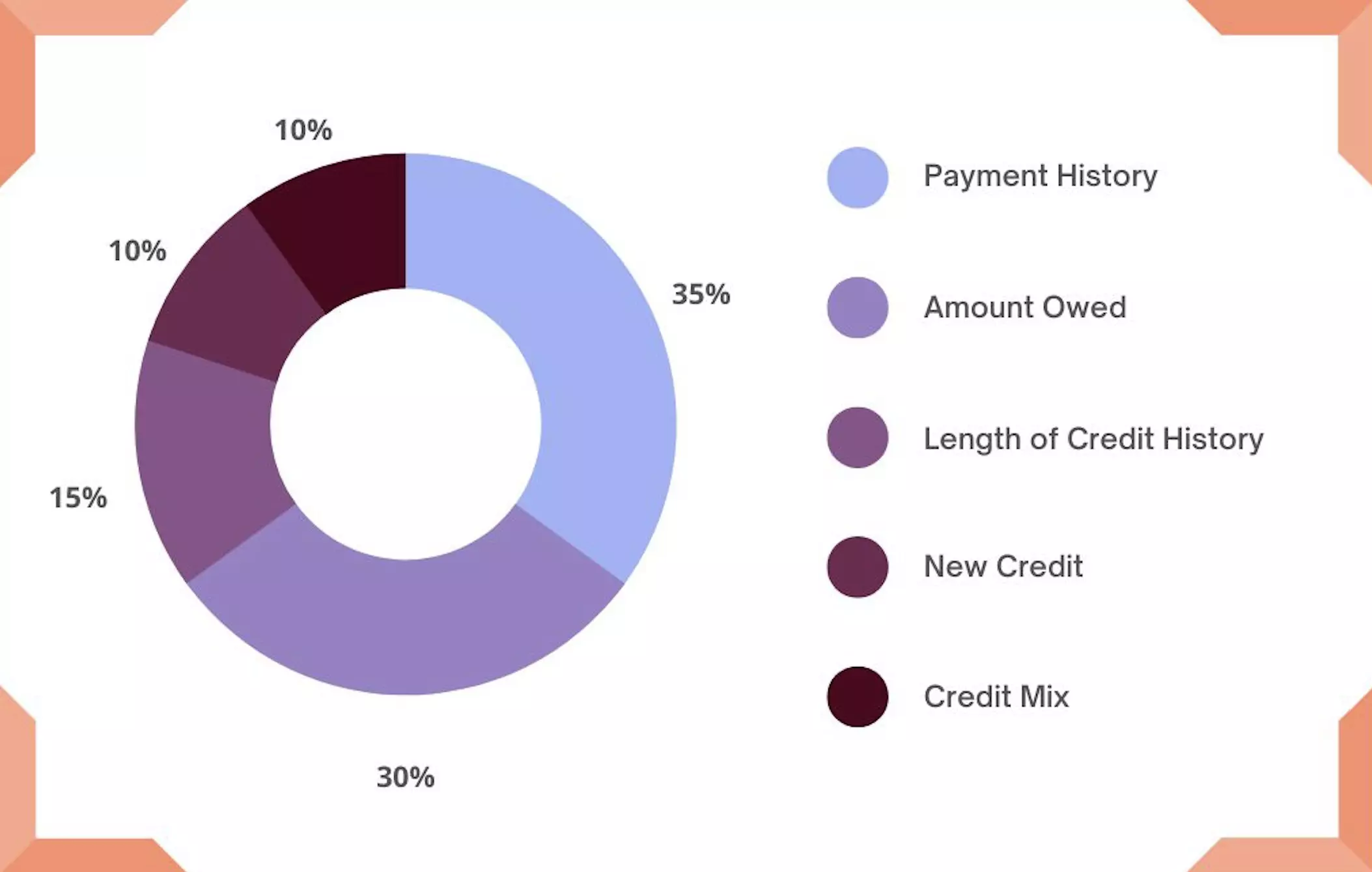

Several factors are taken into consideration when determining your credit score. These factors include your payment history, the total amount of debt owed, length of credit history, new credit, and credit mix.

While each of these factors influences your overall credit score, some are weighed more heavily than others.

Payment History

Most of your credit is based on your payment consistency and timeliness. This category makes up 35% of your credit score and takes into consideration defaults, late payments, bankruptcies, collections, and delinquencies. Moreover, it also notes the number of times these issues have occurred.

Amount Owed

30% of your credit score is based on how much you owe compared to your available credit. In other words, it is how close you are to your credit limits. Additionally, it considers the number and types of open accounts you have.

Length of Credit History

Your credit is also based on how long your accounts have been open, in use, and paid on time. Although this accounts for 15% of your credit score, it is still an indicator of responsible financial activity.

New Credit

10% of your credit score is determined by the number of times you apply for new credit. The higher the number, the more likely your credit score will be negatively impacted.

Credit Mix

The types of credit you have is also considered, such as large-sum mortgages and small-sum retail store cards. This makes up 10% of your credit score.

What Do Lenders See When You Apply for a Loan?

When you apply for a loan, a lender will look into your personal, credit-related information to verify your identity and determine your eligibility for financing.

Therefore, it is a good idea to understand these factors before applying to avoid surprises on your credit report. Some factors a lender may look into include the following:

Personal Information

- Your current and former names

- Your current and former addresses

- Your date of birth

Financial Information

- Income. Your income is often used to verify your ability to pay debts back. This is also a factor in determining your debt-to-income ratio (DTI). Your DTI monitors how much of your income is consumed by debt repayments, so keeping a lower DTI is favourable.

- Capital. Emergency savings, investment accounts, and other capital can help you manage debt payments even if your income changes.

- Collateral. Items of collateral can sometimes be used to secure a loan as they are a safety for lenders in case you default. Common forms of collateral include automobiles and property.

Credit-Specific Information

- Late Payments. Late credit payments can negatively impact your credit score. Defaulted loan payments can stay on your credit record for up to six years.

- Collection Accounts. Often, creditors sell or assign accounts with defaulted or late payments to a collection agency. Collections accounts can deter lenders from loaning to you in the future, so it is important to maintain steady repayments on loans and credit cards.

- Debt. Active debt appears in credit reports, and the higher the number of active obligations, the higher your DTI becomes. Managing your active debt to maintain a lower DTI can improve your credit score.

- Hard Credit Inquiries. Hard credit inquiries are run any time a large line of credit is applied for, such as auto loans, mortgages, or credit card applications.

- Fraud History. Any history of fraud is tracked and shared with your credit report by the Fraud Prevention Service, CIFAS. This can be seen by lenders but should not negatively affect your ability to qualify for new lines of credit.

Personal items won’t affect your credit but are used to verify your identity and ensure that all credit history is accounted for. However, credit-specific elements may impact your credit score and are often cross-referenced with financial information.

Best Ways to Improve Your Credit Score

Improving your credit score can be the best way to manage your financial health in a better way. Ultimately, this can lead to more financial stability in the long run. However, there is no “one size fits all” solution to improve or maintain your credit score. Ultimately, sustainable credit maintenance may look different from person to person.

Nevertheless, here are a few actionable ways you can improve your credit score:

Timely Payments

Paying off your debts on time can help you boost your credit score. Conversely, missing payments or paying late can dramatically lower your credit score, even if it is only once or twice a year. In addition to making payments on time, the following actions may give an additional boost to your credit score:

- Paying more than the minimum amount

- Paying earlier than the due date

- Making more than one payment during the same statement cycle

- Keeping credit card statements low

- Avoiding frequent credit applications

To help prevent falling behind on payments, you can:

- Create a filing system, either paper or digital, to track monthly bills.

- Set due-date alerts so you know when a bill is coming up. This can also be done manually or with the help of online and mobile budgeting apps.

- Automate bill payments from your bank account.

Should You Completely Pay Off Your Loan?

It may sound counterintuitive, but sometimes having debt can be beneficial. Let’s take a look at some instances where you may refrain from completely paying off your debts:

- Building History. If you are trying to rebuild a damaged credit score or build credit for the first time, making timely payments for an extended period can be beneficial. Since payment history accounts for 35% of your credit score, building a healthy history can improve your overall credit impression.

- Diversifying Your Credit Mix. There are different types of debt, such as personal loans and credit cards. Credit cards are revolving lines of credit, meaning the account is not closed once the outstanding balance is paid. Conversely, personal loan accounts are closed once the debt is repaid. In some cases, completely paying off personal loans may hurt your credit as it decreases the diversity of your credit mix.

- Low Debt Amount. If you have multiple types of debt, they are likely in varying amounts. If the outstanding balance on your credit card is higher than your personal loan, your credit score might not improve by paying off the lower amount. This is because your credit utilisation and DTI will still be high.

Improve Your Debt-to-Income Ratio

The debt-to-income ratio is the percentage of your income compared to your outstanding debts. For instance, a DTI ratio of 10% means that 10% of your monthly income is spent repaying debt. Typically, a DTI ratio of 36% or below is ideal.

A low DTI ratio demonstrates that you have a good understanding of financial literacy and practise healthy spending and saving habits. Improving your Debt-to-Income ratio can signal to lenders that you are financially responsible. There are a few ways to lower this ratio and set yourself up with a plan to reduce it over time.

- Pay large loans in full. Getting larger loans off your credit reports will lower your DTI and show lenders that you have a history of successfully maintaining loan repayments.

- Consolidate loans. Consolidating loans can be helpful for borrowers who have multiple loans in varying amounts and with different interest rates. If you qualify, you may be able to combine those loans into one. Often, consolidation loans offer lower interest rates for eligible borrowers. This option can also make repayments easier, as you only need to make one payment per month. However, consolidation loans may have higher eligibility requirements.

- Prioritise larger monthly payments. Getting larger chunks of loans out of the way will show a more significant decrease in your DTI over time and will also save more on interest in the long run, as interest on those higher loans will rack up quicker than interest on a small loan.

Limit the Number of Times You Apply

Each time you apply for credit, you will be subject to a hard credit check. This can temporarily lower your credit score. Additionally, a hard credit check will appear on your report for 12 months.

According to Experian, refraining from opening a new account for six months can improve your credit score by 50 points. Therefore, it is best to avoid opening too many lines of credit at once. If you must, try to wait between three and 12 months between new accounts.

Also, utilise eligibility calculators to estimate your chances of approval before committing to a hard credit check. Most banks offer complimentary soft credit checks for account holders. Simply log in to your account online or through the app and request a credit inquiry.

Watch Out for Fraud

When looking at how to improve your credit score, keeping an eye out for fraudulent activity is also helpful. Here are some tips on how to prevent credit fraud:

- Monitor Statements. First, monitor your statements to ensure unauthorised users don’t make large purchases with your credit or debit cards. If you notice suspicious activity, reach out to your bank and credit card issuers so they can freeze your accounts. Additionally, you should contact a credit bureau to report this activity. The bureau will conduct an investigation and fix the errors on your credit report.

- Maintain Secure Passwords. Having unique and rotating passwords can help keep your accounts secure. Consider changing your passwords routinely and avoiding using the same ones for different accounts, especially financial ones.

- Avoid Unfamiliar Links. Make sure you are not sharing your credit information anywhere that doesn’t seem legitimate. Use caution when submitting online purchases, opening email links, and signing into your bank on unfamiliar devices. These practices can help secure your private information and prevent unauthorised access to your credit.

Borrow Within Your Means

Borrowing more money than you can afford can take a toll on your credit. Failure to pay back your debts could lead to bankruptcy, a county court judgement (CCJ), or an individual voluntary agreement (IVA).

You will receive a CCJ if someone decides to take you to court because you owe them money and have not responded to the charges against you.

With an IVA, the debtor and creditor can set terms for how the debtor will pay back the creditor. For example, the debtor could outline in the contract that they will pay a specific monthly amount for two years. In turn, the creditor might agree to reduce the debt if they receive all the money before two years. This agreement is an example of what could pan out during an IVA and depends entirely on what the debtor and creditor negotiate.

It is important to note that bankruptcy, a CCJ, and an IVA can significantly lower your score. They could also stay on your credit report for up to six years, impacting how long it takes to build your credit.

Here are some tips to lower your chances of overborrowing:

- Monitoring Your DTI. DTI is just as helpful a tool to lenders as it is to consumers, as it can help you maintain a healthy balance of income to debt. Consider setting a DTI limit to prevent you from exceeding your financial means.

- Maintaining a Budget. Budgeting ensures that you have a guideline for your paychecks and that your loans are covered in case of emergencies. The 50/30/20 rule can be used as a foundation, but every budget will look different depending on a person’s needs and income.

Get on the Electoral Roll

While it won’t improve your score, you should ensure that you are on the electoral roll.

The electoral roll, or the electoral register, is a list of everyone allowed to vote in the UK. Your credit report shows if you are on the list or not, and lenders may gauge creditworthiness based on if you are on the list. You might have difficulty being accepted for credit if you are not on the electoral roll.

To register for the electoral roll, you must submit your information on the official government website. Then, when you register to vote, your information is saved on your report, which helps lenders and credit agencies verify your identity. It also helps save you time since some lenders and agencies might not have to ask for forms of identification and proof of address since that information can be found on your electoral roll details.

Credit Monitoring

Credit monitoring tracks your credit history for shifts in the score and overall health of debt, credit, and finances. Tracking your progress can help curb fraudulent activity and prevent potential damage to your credit score. Credit monitoring can look a few different ways:

- Check Bank Accounts Weekly. Review activity in your bank account to see what your average spending looks like and to avoid overspending.

- Register for Credit Card Alerts. Credit card alerts can immediately alert you to unauthorised payments or purchases. As a result, you can take swift action to avoid negatively impacting your credit.

- Thoroughly Read Credit Card Statements. Keeping track of what purchases you typically make over the course of a statement cycle can aid in creating a more airtight budget. Credit card statements are also a running record of all your purchases. So scanning for unauthorised purchases is a great way to prevent fraud.

- Register with Credit Monitoring Services. Credit monitoring sites can offer insight into what is weakening your credit versus pulling your score up so that you can direct your efforts towards the areas that need strengthening.

Why is a Good Credit Score Important?

A high credit score looks good to lending companies because it shows that you are reliable and manage your payments on time.

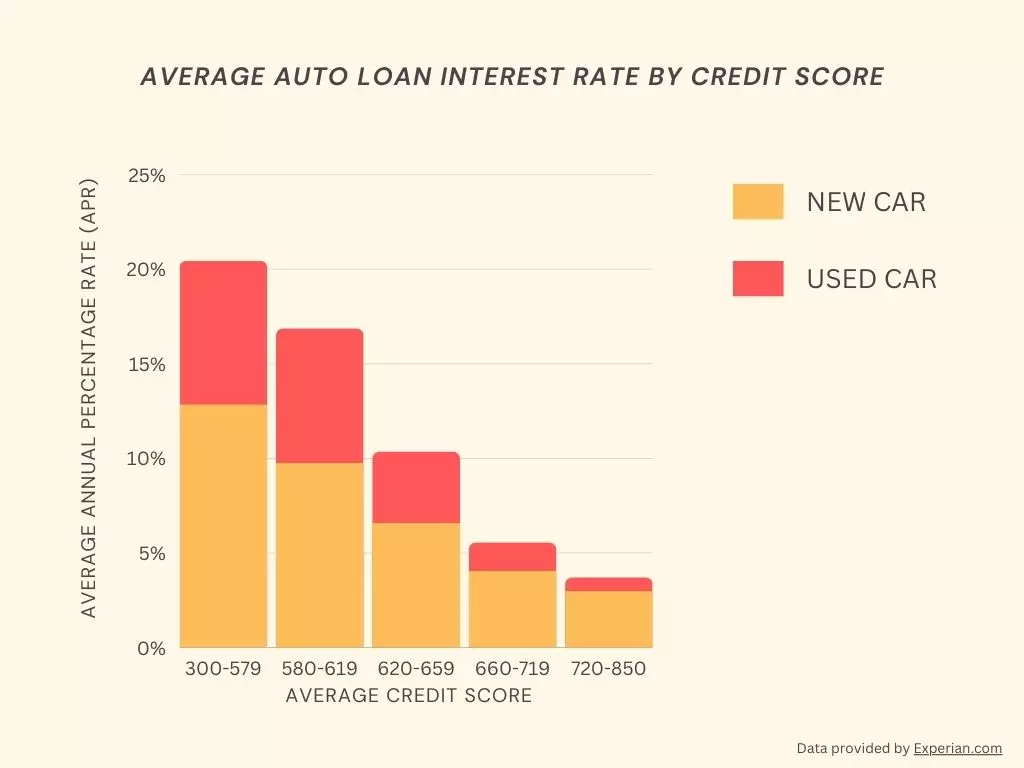

One of the biggest benefits of having a good credit score is the inverse relationship between credit scores and interest rates. Typically, the higher your credit score, the lower the interest rate you may be eligible for. So, depending on the size of the loan, having a higher credit score could save you thousands in interest.

Here is how your credit score could impact your interest rate:

A higher credit score may also give you a better opportunity to borrow more money with higher credit limits. This can be helpful for big purchases, such as a new car or home.

How Long Does It Take to Improve Your Credit Score?

Although you may be eager to boost your credit score quickly, you must keep in mind that it will likely take time to improve. And generally, your credit score will fluctuate slightly month-to-month because of shifts in your revolving credit. Nevertheless, your credit score may improve within six months to a year, depending on the steps you take.

For reference, a new bank account or credit card takes a few weeks to show up on your credit report. However, these accounts would need to mature for you to begin seeing an improvement in your credit score. If you are expecting a credit improvement because a negative mark is being removed, you may see a boost in your score as soon as those statements are taken off your credit report. However, organically building a healthy repayment history after having a poor history can take anywhere from six months to years, depending on your credit status.

A Temporary Solution to Bad Credit

If you are short on cash or need to make a purchase and cannot access the funds because of your credit score, you may be able to apply for an online payday loan or an emergency loan. This can be helpful for those who are still in the process of building their credit. For instance, if you make timely payments, you may see improvements in your credit score.

However, only borrow what you can pay off with your next paycheck, or you can potentially go into debt and owe even more money. Additionally, lenders will check your credit score and whether you can pay them back, so it is always best to do your research first.

Another temporary solution includes reviewing your credit report for errors or fully resolved entries. Credit entries can be disputed and, if approved, removed from the record to improve your overall score.

However, negative entries can have a residual effect even after the issue is resolved, so reach out to any fully repaid collection agencies or organisations who have logged late payments on your report to see if those entries can be removed.

How to Keep Your Credit Score Healthy

Improving your credit score isn’t a one-time effort. Instead, you should continuously try to maintain your credit health. To do so, you can:

- Conduct regular credit checks. Each of the three credit bureaus offers one free credit check a year. As a result, you can check your score every four months.

- Report any suspicious activity or errors on your accounts.

- Keep your credit utilisation low.

- Keep older accounts and regularly use them for small-sum purchases.

- Make regular or early payments if you won’t incur a prepayment penalty.

- Limit the number of times you apply, and only apply for the minimum amount you need.