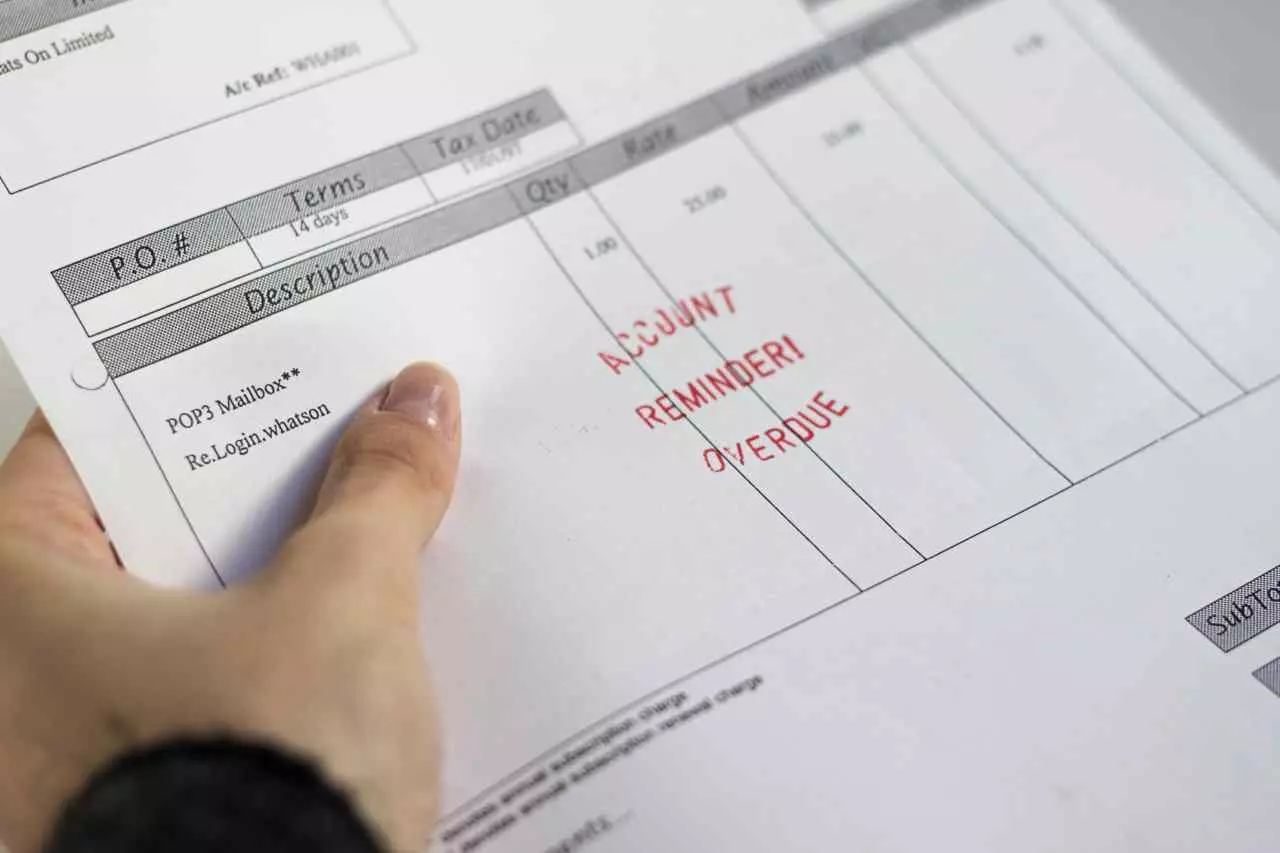

Are you being hounded by a debt collector for your outstanding payments? Knowing how long debt can legally be chased for and why a debt collector is coming after you can help you prepare for what to do in these types of situations. Here is some important information for debt help.

How Long Before a Debt is Uncollectible in the UK?

Most debts can be chased for up to six years from your last payment or last written contact with the debtor. However, different rules apply to mortgages. A creditor can chase the mortgage amount for 12 years. But the creditor can only chase the interest on the mortgage for six years. After this time has passed, the debt becomes statute-barred.

Other types of debt that have different periods include personal injury claims, capital gains tax, and council tax. For example, if you have capital gains tax debt, the HM Revenue and Customs (HMRC) can take you to court as there is no limitation period for this tax. Conversely, personal injury claims have a limitation period of three years.

Statute Barred Debt

A statute-barred debt means that the creditor waited too long to take action in court, which means the debt becomes unenforceable and uncollectable. This means that the creditor can no longer force you to pay your debt. As a result, you will not be required or responsible for paying off the debt. Additionally, the creditor cannot obtain a court judgment to make you repay the debt. This statute applies to borrowers in England, Wales, and Northern Ireland.

The rules are a bit different in Scotland. In the UK, the limitation period is six years, whereas, in Scotland, the limitation period is five years. The same rules apply when a creditor in Scotland takes too long to chase after a borrower’s debt. The only difference is that instead of the debt becoming unenforceable, it becomes prescribed. Even though it has a different name, it still means that the debt is expired and creditors can no longer pursue chasing the debt.

Other Considerations

First, check with your creditors. If you contact them by phone, you can find out the details of the debt to determine the statute of limitations. It is crucial that you do not write to them if there is a high possibility that your debt is statute-barred. Once you write to them, the six years will restart, and they can legally chase you for your debt. Writing to them includes electronic and digital messages, such as:

- Text messages

- Seeking advice and information via online chats

- Sending handwritten or digitally printed mail via Royal Mail, post, or courier

Here is where it gets a little tricky. For example, if you have a joint payday loan, the actions of both debtors are considered. The individual that corresponds with the creditor in writing will reset their own time. However, if one debtor makes a payment, the time is reset for both individuals on the joint account. Therefore, make sure you are on the same page with your co-debtor, as it can affect both of you if miscommunication occurs.

What to Do If Creditors Are Still Contacting You for Statute-barred Debt

If your debt is statute-barred and you can confirm it, you can ask your creditors to stop contacting you. In this case, you can send them a mail stating that you are not liable for your claim. Refrain from including information about money, including the amount they are seeking. If the creditors do not leave you alone, submit a claim to the Financial Ombudsman. You can reach them at 0800 023 4567, Monday to Friday from 8 a.m. to 8 p.m.

If your creditor files a court order and it is sent to you, do not ignore this. Reply by the deadline stated in the court order. If your debt is statute-barred, mention it when you fill out the court order forms. If your debt is not statute-barred, you will have to respond to the court order, and you are liable for the money you owe the creditor. Your court order will give you details about how and when you will have to pay the creditor back.

Check if You Have Payment Protection Insurance

What happens if you become sick and cannot pay off your debts? Check if your debts are covered with Payment Protection Insurance (PPI). PPI can help cover your debt for a certain amount of time if you are ill, sick, have an accident, or become unemployed. Your debt agreement and paperwork will have information about what is covered. To get more information or find out if you have payment protection insurance, you can also ask the Financial Ombudsman Service or a bank for more information to see if you qualify for PPI.

Know Your Finances

Financial literacy is important and if you need help with your finances, try speaking to a financial advisor or an accountant. Aside from professional help, there are easy changes you can implement to keep track of your finances.

It is essential to monitor how long you have had your debt and which debts you have to pay back. Budgeting, tracking your spendings, and making reminders for payments are convenient ways to avoid late or missed payments. An easy way to do this is to set up automatic payments. If you prefer to pay your bills, set up reminders on your phone or physically write in your planner. Another helpful tip is to figure out which debts can be dealt with and paid off first. Prioritize debts with the shortest limitation period and then work your way to those with a longer limit.

Wrapping It Up

All in all, most debts have a limitation period of six years until the debt becomes unenforceable. Still, it is vital to pay off debts, so you do not end up in a situation that can affect your finances, such as obtaining an emergency loan. Remember, with any financial decision, make sure you do your research and reach out to a financial advisor who can help you through the process. Debt can be scary, but with enough knowledge and preparation, you can tackle it head-on.