Find payday loans that fit your needs

Get a decision in just a few minutes

Request Your Money

Make a Connection

Find a Loan

What is a Payday Loan?

It is a short-term loan that borrowers can use to hold them over until the next payday

Payday loans can be viable resources for emergency cash needs

Why Quidable.co.uk

How do Payday Loans Work?

Request a loan

Interested borrowers can request a payday loan online. The process is typically streamlined for borrower convenience, and consumers can apply directly online. While requirements may vary from lender to lender, the following information is typically required:

- Valid identification and proof of age and UK residency

- Proof of employment

- Bank account information

- Proof of monthly or yearly earnings

If you are approved, your funds may be deposited within a few business days.

How much cash do you need?

Repay your loan

Borrowers typically repay their loans when they receive their next pay cheque. Some lenders may allow long-term payday loans and longer borrowing periods that make one-month payday loans, three-month payday loans, or even six-month payday loans possible. However, these loan products may be referred to by a different name.

Loan repayment can be made by automatic withdrawal or by writing a check, in some cases. Borrowers who provide their lenders with their banking information may allow their lenders to automatically withdraw the full loan amount at the time of repayment. Borrowers can talk with their lenders about available payment options.

Failure to repay a loan or to meet loan terms can result in incurring more fees and higher interest rate charges. Poor loan management may also negatively impact a borrower’s credit score.

Similarly, borrowers who meet loan terms and make payments on time may see positive effects on credit scores. Borrowers can check credit scores periodically through companies like Experian, Equifax, or TransUnion.

In some cases, lenders may be able to extend or refinance loans. This can lead to steeper interest costs, however. Borrowers should note that terms differ from lender to lender and should carefully consider their specific loan agreement and conditions.

Quidable.co.uk is the Right Place to Start

We have a simple and streamlined request process

You can trust our process and our results

Quidable.co.uk operates as a broker. This means that we connect you to a large network of trusted and licensed lenders. After you fill out our quick payday loan request form, we will try to connect you with a reputable lender. Our team of trusted experts can advise you on the appropriate option for your specific financial needs.

Your data and information will remain safe through our secure technology.

What to Keep in Mind

FCA Regulation

Short-term loan laws are regulated by the Financial Conduct Authority or the FCA. According to the FCA, interest rates must be capped at 0.8% per day of the amount borrowed. This means that all interest and loan fees must not be greater than the capped percentage. In addition to this, to protect UK borrowers who may be struggling to pay, default charges must not exceed £15. Under FCA law, interest and default charges must not exceed the initial loan amount.

Potential borrowers should also note that there is a total cost cap of 100%, which protects borrowers from incurring increasing debts. This means that borrowers are not required to pay back more in fees and interest than the original amount borrowed.

The FCA also notes that a customer borrowing a loan for 30 days and who meets their loan terms will not have to pay more than £24 in fees or charges for every £100 that is borrowed.

Further, there are no such things as “no credit check payday loans,” and lenders will, in fact, check an applicant’s credit rating. That said, bad credit payday loans are still possible in many situations.

As per the FCA’s rules, lenders are responsible for ensuring the creditworthiness of their consumers. The most commonly used methods to assess an applicant’s financial situation and affordability are credit rating agencies such as Experian or Equifax.

To this end, there are no guaranteed payday loans for bad credit. Lenders may consider a borrower's income, credit score, credit history, and debt-to-income ratio.

In some cases, however, lenders may offer payday loans to consumers who have poor credit scores or poor credit histories if borrowers add a guarantor to the loan agreement. Applicants should note that this is always left to the discretion of the lender in question and that terms must be agreed upon by both the lending and the borrowing party.

Consumers can read more about the rules and regulations associated with short-term lending on the FCA’s website.

APRs

Payday loans can often carry high fees and APRs. An APR is the annual interest rate of the loan being taken out, which includes the interest charged on the original loan amount, as well as all fees charged by the lender. Many factors go into determining the APR, and most loan providers often use an applicant’s credit score to determine the rate, which may be higher if the loan term is shorter. Rates may vary from lender to lender.

Studies have shown that APR costs for payday loans are typically more expensive than those associated with longer-term loans or more conventional credits. The average APR for short-term loans can be up to 1,500%, compared to the 22.8% average for credit cards.

Despite the rate caps, the FCA reports that of the 5.4 million loans in 2018, borrowers repaid 1.65 times more than the original amount.

quidable.co.uk is not a lending agency. We provide a free service that helps consumers request a loan, and if you find a loan, your lender will show the fees associated with your funding through your loan agreement. You are under no obligation to accept a loan from any of our providers, and you can decline at any time up until you sign the loan agreement.

Warning: Late repayment can cause you serious money problems. For help, go to www.moneyhelper.org.

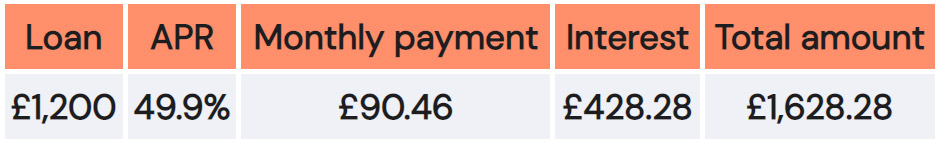

As quidable.co.uk is not a lender, we do not set APR or loan terms. The lenders we work with have 7-day to 84-month loan terms with 18.7% to 1,576% APR. To understand the financial implications of repaying a loan with interest, please consider this representative example: If you were to borrow £1,200 for 18 months with 49.9% APR, your monthly payment would be £90.46. The total amount repayable would be £1,628.28, which includes £428.28 in interest.

Responsible Lending

Although payday loans are viable financial resources for those who are temporarily short on cash, experts warn borrowers to be cautious of predatory lending practices that may trap borrowers in a cycle of debt.

Borrowers should be wary of third-party debt-collection agencies. All agencies must be authorized and comply with the FCA. There are a number of schemes that corrupt lenders or agencies may use to scare, abuse, or threaten borrowers. To avoid being a victim of a lending scam, consumers should keep an eye out for suspicious or irregular activities and behaviors.

These may include:

Staying Proactive

Borrowers should make sure they are working with legitimate lenders that are authorized by the FCA and have the appropriate licenses necessary.

Borrowers should:

Alternatives to Payday Loans

Seventy-five percent of UK consumers take out more than one loan in a year, while the average customer takes out six loans in a year. And in some cases, debtors take out more loans to pay for their previous loan balances.

Consumers should only opt for a payday loan if they can repay the amount borrowed and fully understand the terms and conditions associated with their loans.

Alternatives to payday loans may include:

Consulting Community Development Finance Institutions (CDFIs):

Personal loan:

Paycheck advance:

Cutting discretionary spending:

Borrowing from a trusted friend or family member:

Asking for payment extensions:

Utilizing welfare assistance programs:

- UK residents have a number of assistance programs at their disposal. Those who are London residents can consider the Children’s Society website for some resources.

- Scotland residents can visit their government website to inquire about local financial assistance programs.

- The Discretionary Assistance Fund for Wales can be a viable resource for those who reside in the country, and likewise, financial support is also available specifically for Northern Ireland residents.

Make a budget

Financial experts suggest making a budget to determine loan affordability. Budgets may not only promote responsible debt management but can also help highlight positive or negative financial habits that need to be assessed.

Experts suggest following a 50/30/20 budgeting plan:

Saving 20% of each monthly income provides a sense of security in the event of a financial emergency and can subsequently reduce monetary stress.

Consumers can also choose to speak to a financial advisor. Financial advisors can offer a wealth of knowledge and experience regarding the best spending practices. Planners can also offer impartial opinions about your money and give insight into areas that can be steered in the right direction. With a third-party opinion, monetary issues might seem more bearable.

Residents of the United Kingdom can utilize online budgeting tools and planners to manage their money better.

Each UK household spent or invested more than £900, on average, than it received in income in 2017, according to the Office for National Statistics.

This shortfall led to borrowing or dipping into savings. In fact, families took out almost £80 billion in loans in the same year but only saved £37 billion with UK banks, which was the lowest amount since 2011.

Financial experts also advise that borrowers save more in order to avoid high-cost lending.